dLocal (The Compounder Score)

Incredibly efficient company with a 30% expected growth

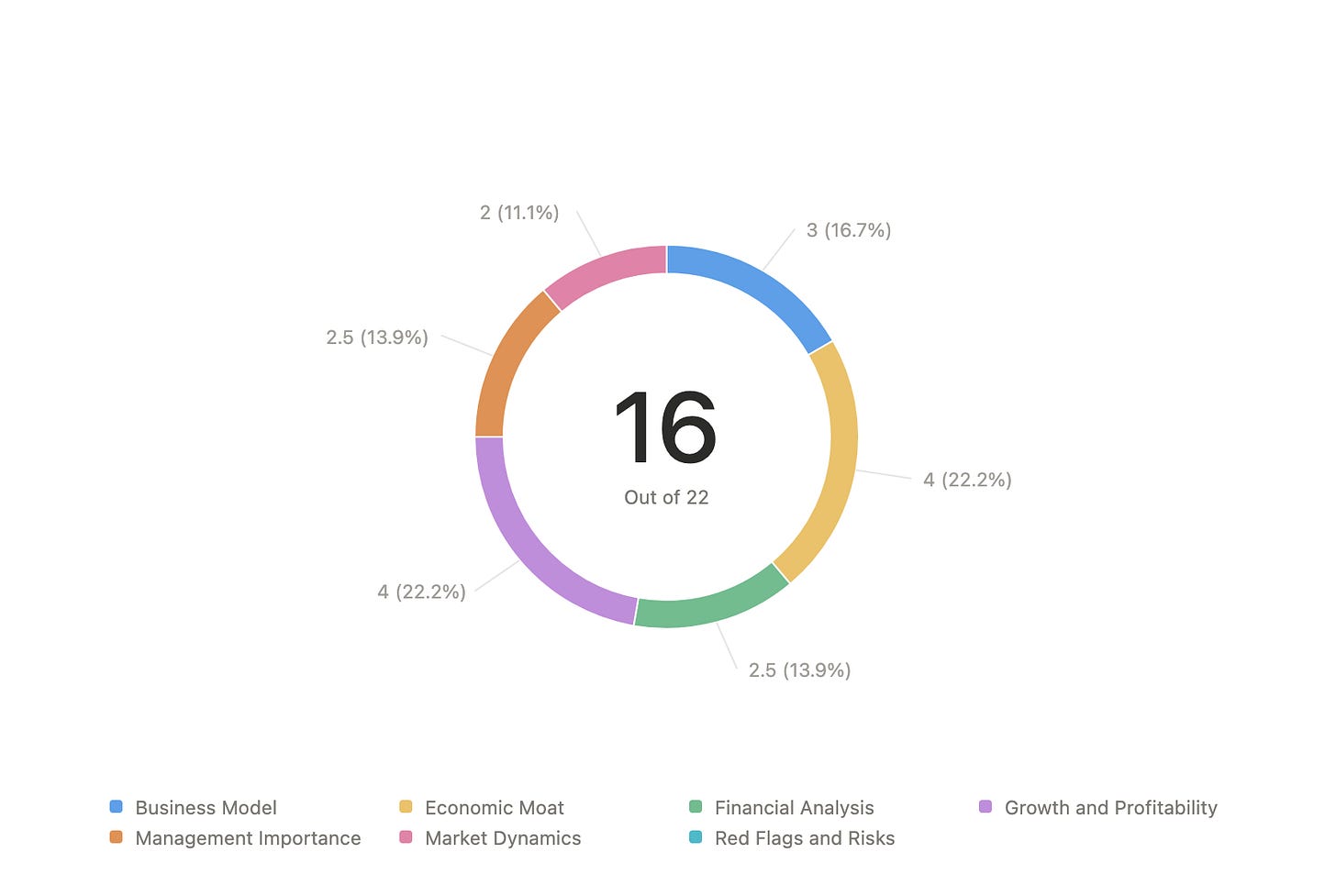

I applied The Compounder Score—a weighted framework for assessing companies’ fundamentals—as a preliminary screening tool to determine if dLocal ($DLO) warrants a full deep-dive analysis.

The maximum score is 22 and the ranking system is as follows:

12 and below: High Risk/Pass

13 to 15: Viable

16 to 18: High Conviction

19 and above: Best-in-Class

The Compounder Score

dLocal is a cross-border payment platform that connects global enterprise merchants and consumers in emerging markets (EMs), where international credit cards are often not used or accepted. Through a sophisticated API, the company is able to simplify the inherent complexity of localized card processing, bank transfers, compliance, tax, and currency regulations which differs in each EM. Due to having a physical presence and regulatory licenses in ever market, it is able to offer over 900 local and alternative payment methods (APMs), essential for large, multinational clients.

The company charges a transaction-based fee called the take rate as a percentage of the Total Payment Volume (TPV) it processes for its clients, which applies for both its collection and its disbursement services. This asset-light model provides substantial operating leverage, which may lead to strong profitability and stable margins. However, its recent focus on larger customers and more competitive markets has caused a sustained margin contraction.

Let’s analyze the company by using The Compounder Score:

1. Management Importance

“Skin in the Game” and Incentives: (2/2)

According to Simply Wallst, individual insiders account for over 47.4% of the total ownership in the company, with most of this ownership belonging to the company’s Co-Founders. This is clearly a significant amount which represents that management has “Skin in the Game”.

Despite dLocal’s compensation not being fully disclosed in their annual report, it is stated that their directors are not paid a salary, but are solely compensated from owning the stock and collecting dividends, outlining their alignment to investors’ objectives.

“Historically, our directors have not been paid separate compensation and have received only dividends in respect of their ownership of our common shares” - dLocal’s 2024 Annual Report

Business Resilience to Management: (0.5/1)

Since dLocal was founded in 2016, it has had two CEOs, Sebastián Kanovich, one of the Co-Founders, and Pedro Arnt, who joined in 2023.

dLocal’s business of facilitating cross-border payments in over 40 EMs is not simple, as its competitive moat emerges from being able to navigate the high complexity from volatile foreign exchange, fragmented LATAM banking systems, and dynamic regulatory environments. The recent CEO transition to Pedro Arnt is the critical test to see if the company’s structure is mature enough to ensure resilience to management, which has so far been a success.

2. Market Dynamics

Large and Growing TAM: (1/1)

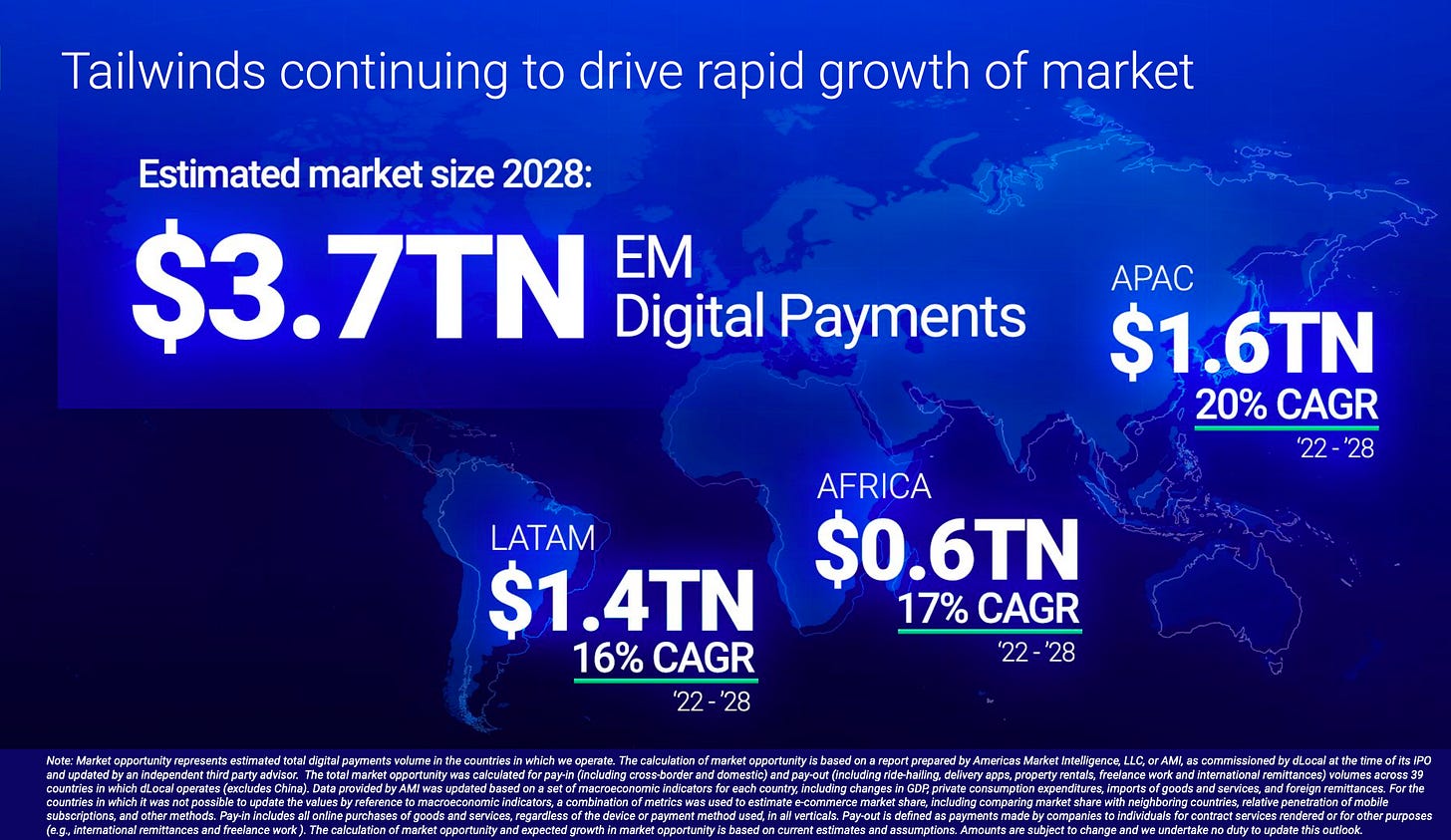

dLocal estimates its industry to reach over $3.7 trillion of digital payments to take place in EMs in 2028.

This growth is expected to be by the rapid growth of emerging markets, with APAC expected to grow at a 20% CAGR.

Exposure to Secular Trends: (1/1)

dLocal’s offerings benefit from several powerful secular trends:

Digitalization of EMs: Increasing internet and smartphone usage, adding billions of consumers into the digital economy via mobile wallets.

Penetration of E-Commerce: Higher demand for online shopping with the penetration in countries such as Nigeria, Brasil or Mexico expected to grow at over 17% CAGRs.

Consumer Spending: Growing middle-class, translating into much faster consumer growth in comparison to developed economies.

3. Business Model

Asset-Light Model: (1/1)

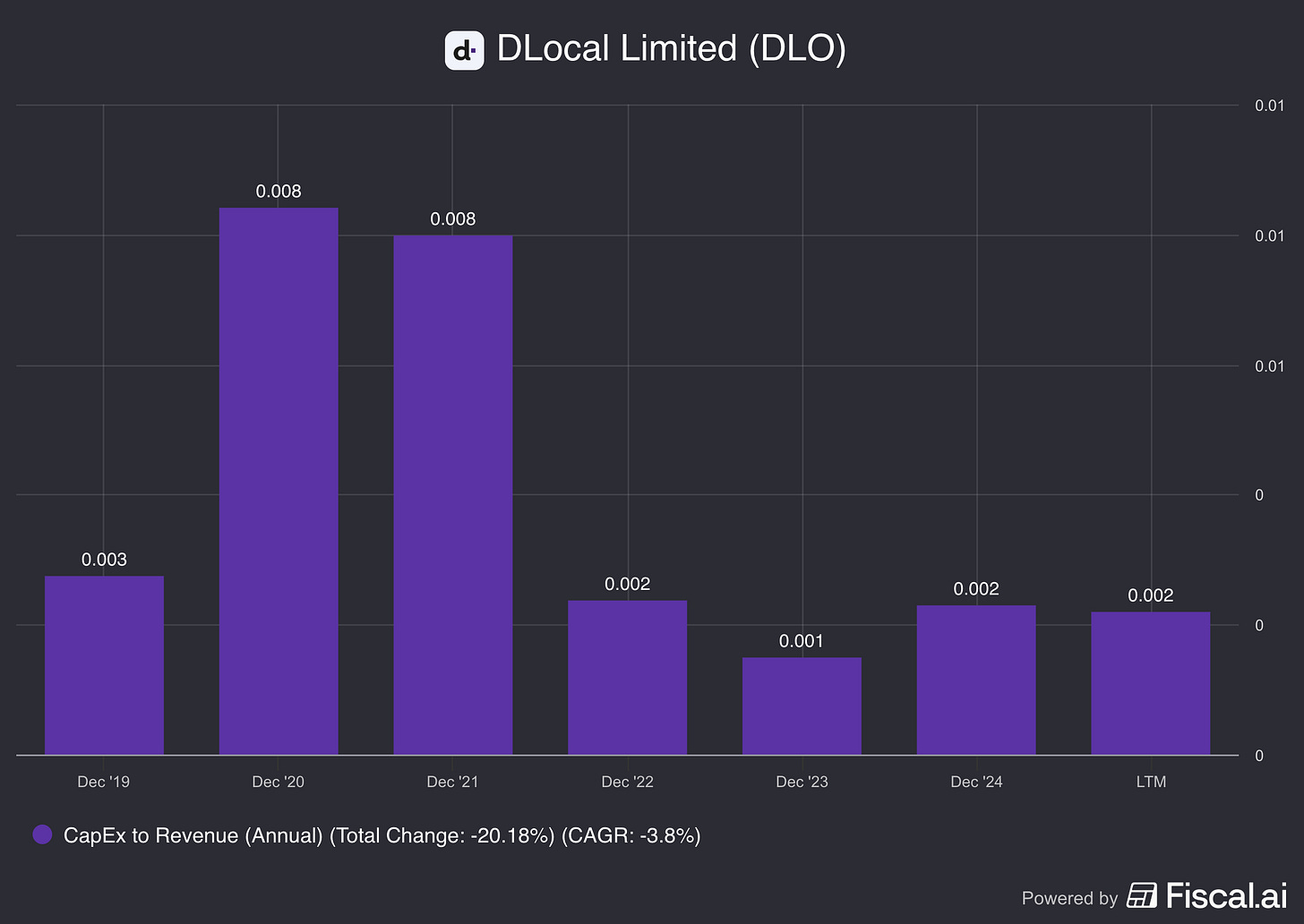

dLocal has consistently maintained a CAPEX ratio of under 3% of its revenue for the past 3 years, allowing them to be considered an asset-light business.

High Portion of Recurring Revenue: (1/1)

dLocal mainly generates revenue via transaction-based processing fees, providing highly predictable income streams, as these charges are a compulsory cost for merchants to accept essential digital payments.

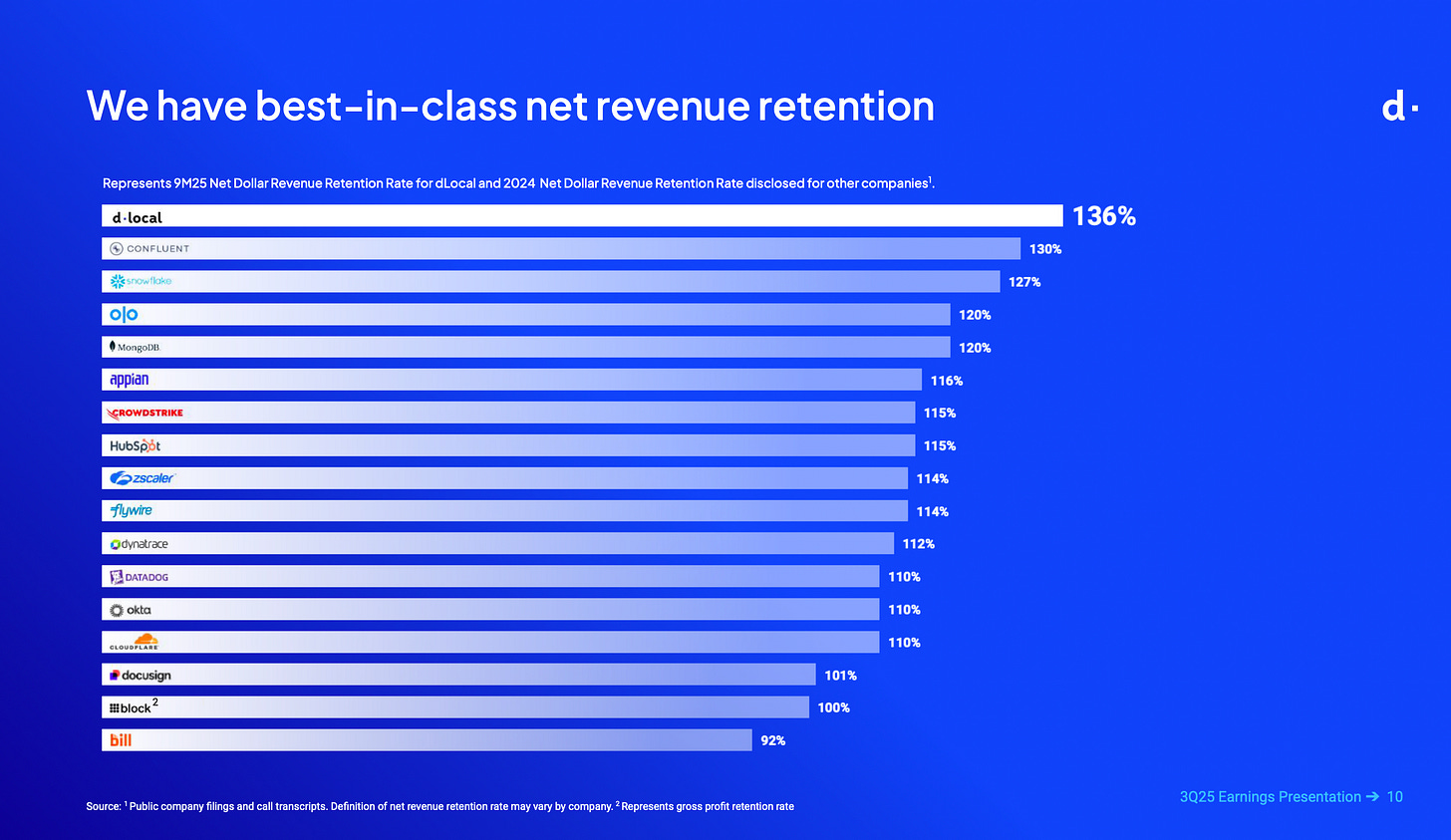

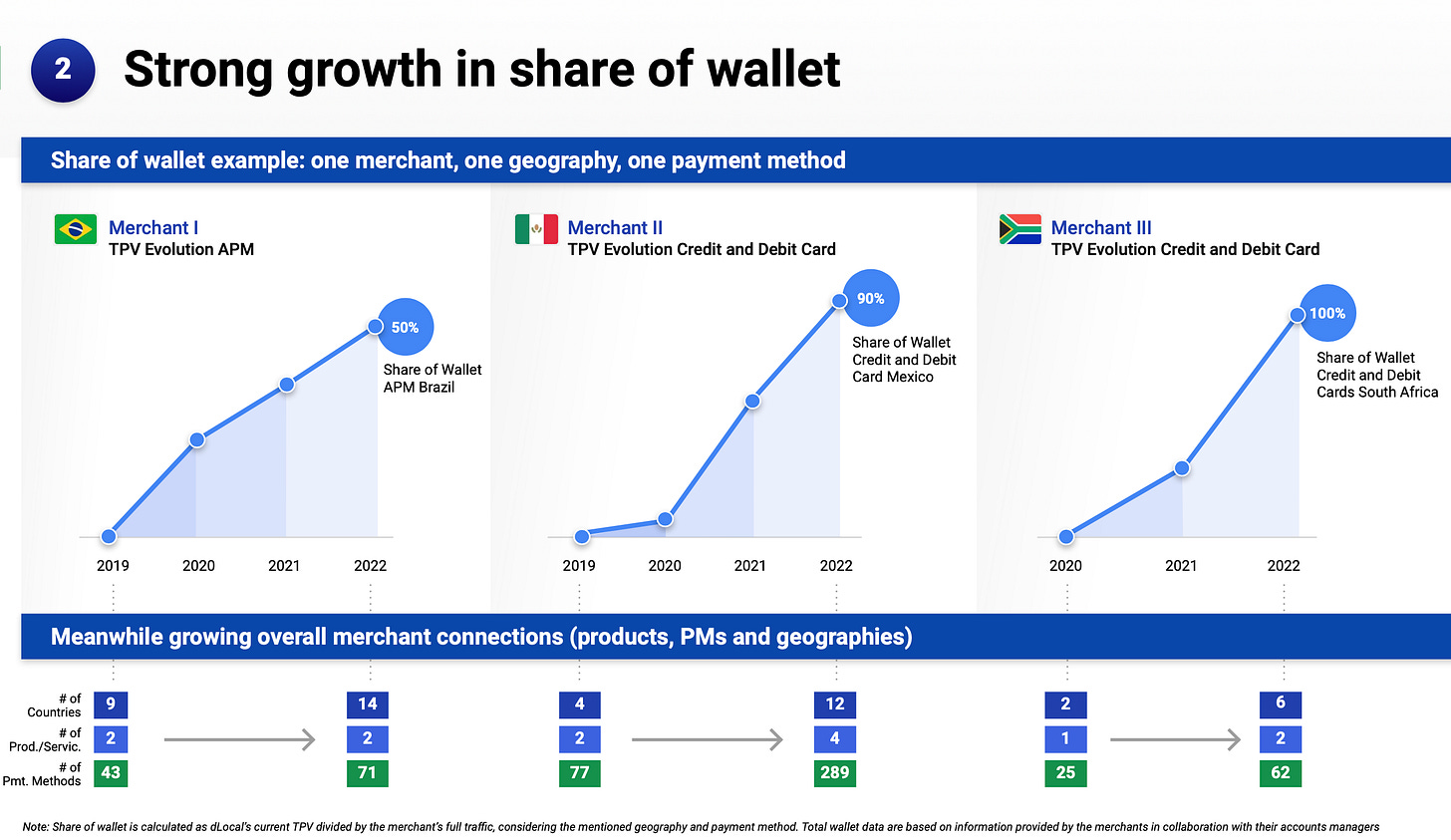

This has allowed the company to enjoy an industry leading 149% NRR, indicating that existing customers are increasing their spending with dLocal year after year by adding more products and launching in new countries.

Margin Stability / Growth: (1/2)

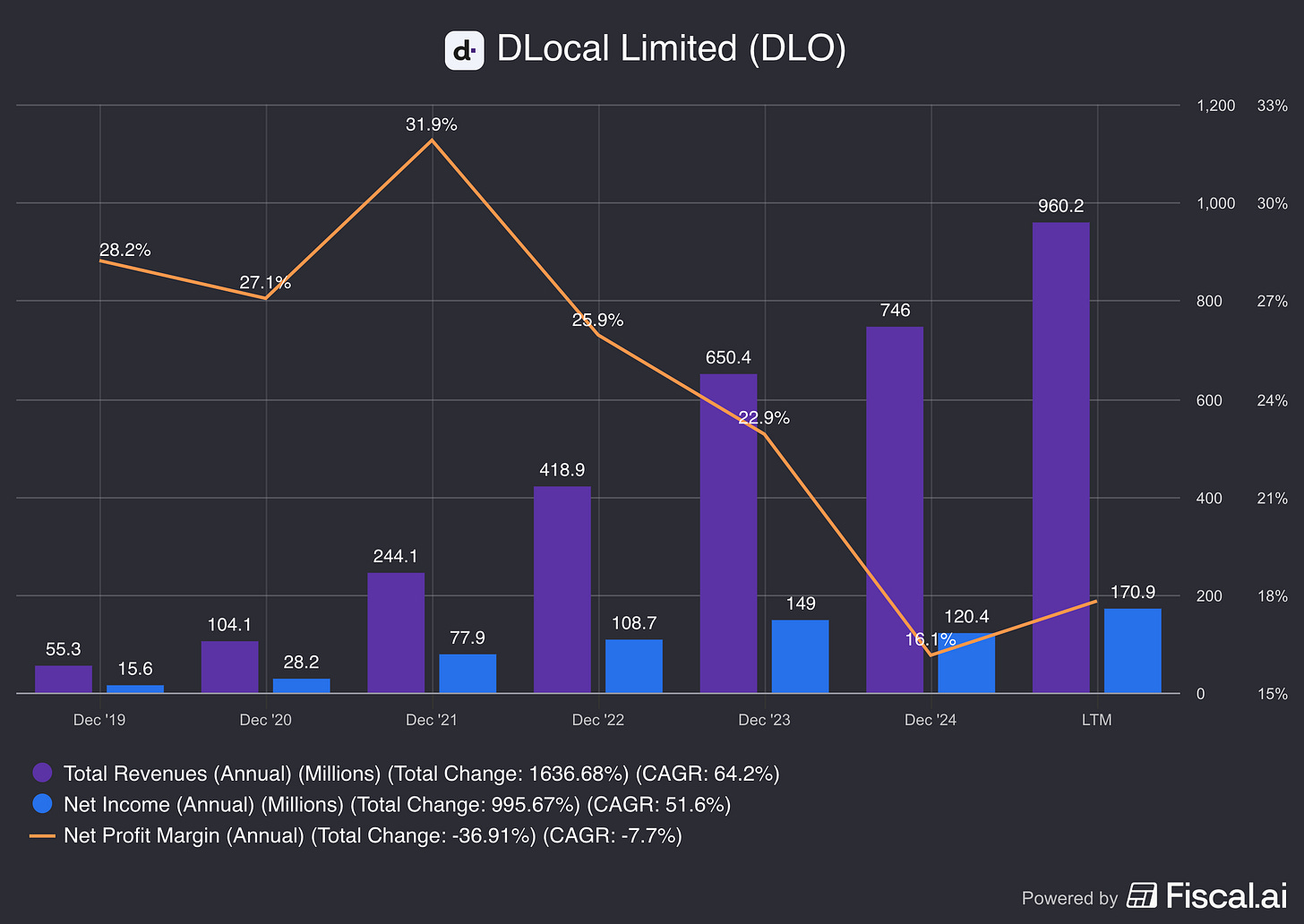

dLocal’s margins have been decreasing every year since 2021, with the net margin contracting from 32% in 2021 to 16% in 2024.

This decrease has been caused due to pricing pressures and product mix changes as the company has been partnering with high-volume, global enterprise merchants, at the cost of having to offer lower take rates to merchants as they hit volume thresholds.

Now, even though dLocal’s business model has high potential for margin expansion, we do have to consider that its margins are not stable due to volatility in its EMs, as factors such as currency devaluation (Argentina, Nigeria) have shown in the past.

4. Economic Moat

Sustainable Competitive Advantage: (2/2)

DLO 0.00%↑ is developing a narrow moat mainly based on its high switching costs and intangible assets.

Once a large global merchant like Uber integrates dLocal’s “One API” into their core payment infrastructure for dozens of EMs, the time, complexity, and regulatory risk of switching to a competitor is substantial. Additionally, as dLocal’s solution is required to operate in these markets, attempting to replace it would be operationally disruptive and could affect the merchant’s sales.

On the other hand, the company’s deep expertise in local regulations, compliance, and payment preferences across 40+ EMs is a massive, hard-to-replicate intangible asset. dLocal has a strong relationship with EM financial institutions and over 900 payment methods which creates a barrier to entry that competitors like Adyen struggle to match in EMs.

Pricing Power: (0/1)

dLocal does not have the ability to raise its prices without experiencing a significant loss of customers. This is a structural reality of its high-volume, transaction-fee based model, where even a marginal 0.1% increase in the fee can translate into millions of dollars in added cost for large merchants.

Even though, the company’s true pricing power lies in its ability to cross-sell high-margin value-added services (such as fraud prevention and treasury services) to its existing customers, the company is focusing on winning major enterprise accounts. This creates downward pressure on the company’s take rate due to the provision of volume-based discounts.

Dominant or Disruptive Position: (1/1)

dLocal is a clear leader in a highly specialized market niche, evidenced by no competitor being able to replicate its level of depth or regulatory coverage across over 40 EMs.

Additionally, the company has been a powerful disruptor as it has managed to transform the slow, expensive cross-border transfers once offered by legacy financial systems.

Embedded in Customer Behavior: (1/1)

dLocal is considered a “need-to-have” provider as it is essential for global merchants to accept local payment methods and navigate complex regulatory environments in EMs. Once integrated, the business continuity risk associated with changing providers means the service is viewed as a highly-integrated necessity rather than an easily replaceable provider.

5. Financial Analysis

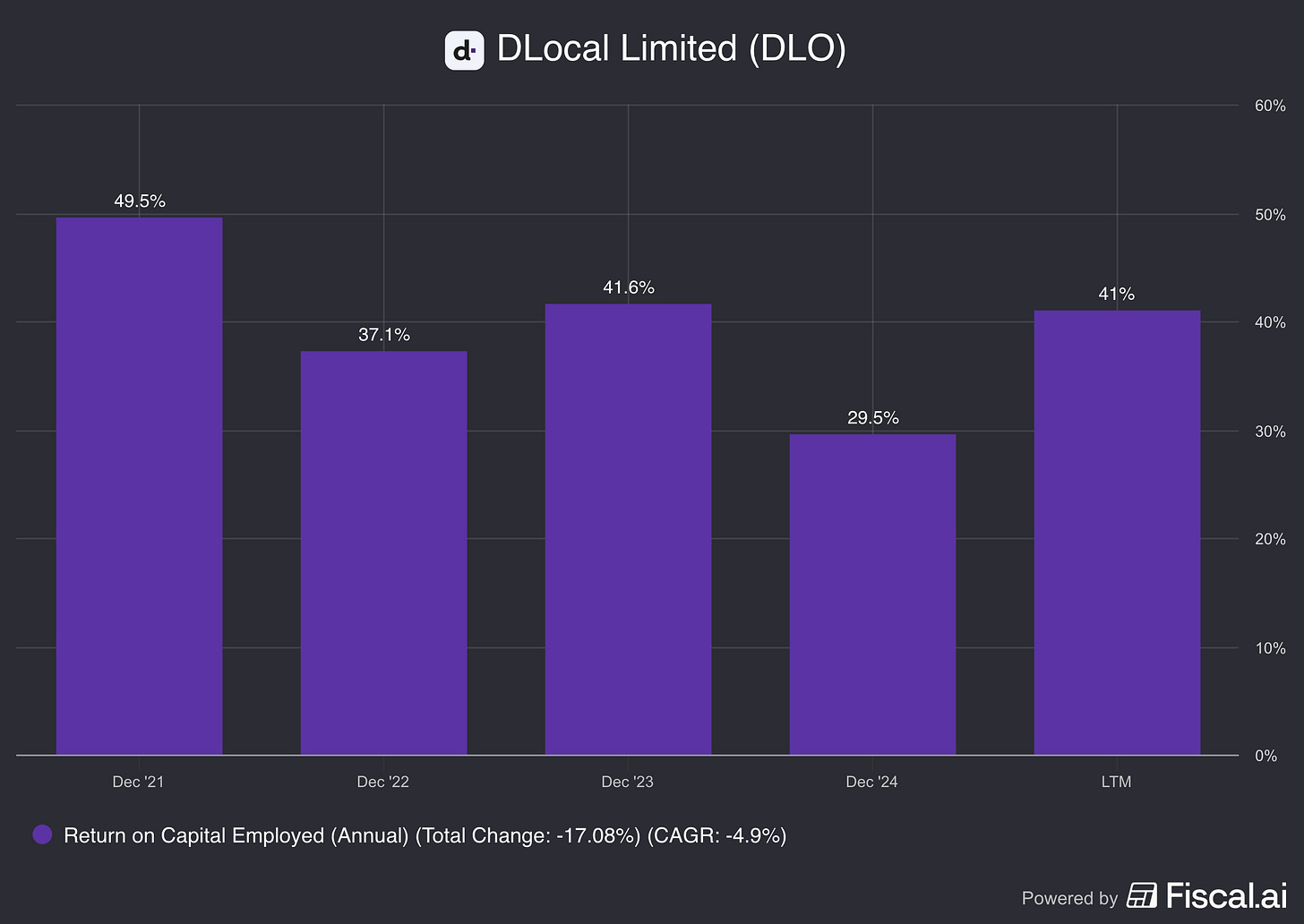

ROCE: (2/2)

dLocal has an impressive average ROCE of 39% over the past 5 years. However, this ratio has shrunk from 50% in 2021 to 30% in 2024, mainly due to the company’s contracting net margin.

Regardless, since this ratio has been kept way above our threshold of 15% for a sustained time period, we can assume the company will be able to keep generating value for shareholders in the long term.

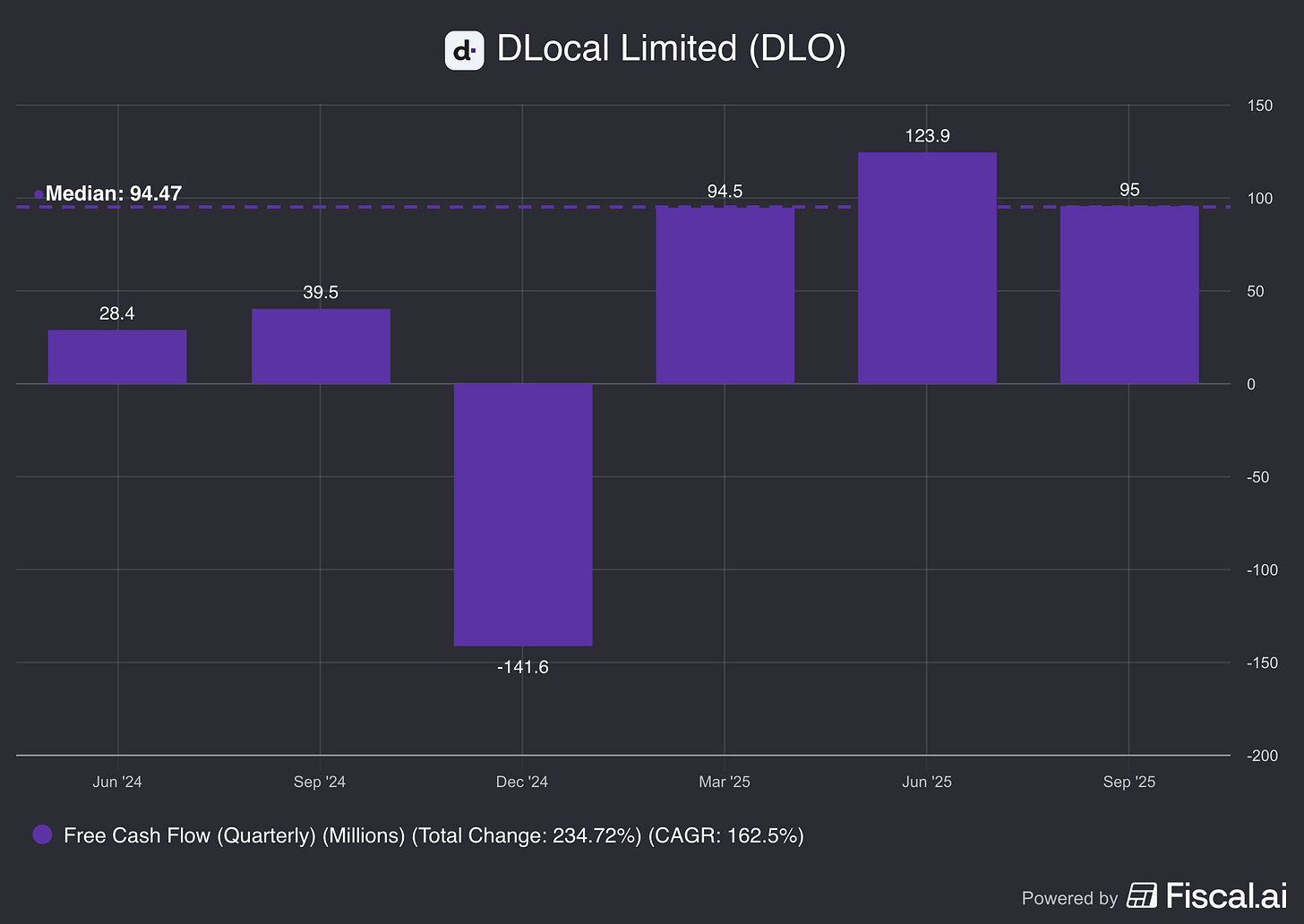

Free Cash Flow Consistency: (0.5/1)

dLocal has established a record of highly predictable and consistent FCF generation, which is evident as most of their quarterly results are close to the period’s median of $94.5 million. This is something we look for when researching companies as it reduces investment risk and supports higher valuation multiples for the stock.

Q4 2024 can be seen as an extraordinary event caused by unfavorable accounts receivable and accounts payable changes through the quarter.

Resilience & Cyclicality: (0/1)

dLocal’s business is highly sensitive to economic downturns due to its intense focus on EMs and its transaction-fee based business model, which is heavily affected by the lower consumer consumption which takes place during recessions.

6. Growth and Profitability

Sustainable Double-Digit Growth: (1/1)

DLO 0.00%↑ is estimated to achieve revenues of $1.63 billion in 2028 (TradingView). When considering that their revenues in 2024 were $0.75 billion, this projection would indicate a 29.8% revenue growth CAGR, which is well above the double-digit growth we would expect to see.

Growth Levers: (1/1)

dLocal has a clear plan for future expansion. The company's strategy can be divided into three main pillars:

Seeking vertical diversification by growing in new high-take-rate segments such as remittances and platform / marketplace disbursements.

Introduce new solutions such as BNPL aggregation, stablecoin corridors, and KYC-as-a-service.

Expand geographically beyond Latin America into Asia and the Middle East (following its success in the UAE, Turkey, and the Philippines).

Pathway to Profitability: (2/2)

dLocal turned profitable in 2016 and has since been profitable every single year.

7. Red Flags and Risks

Lack of an Economic Moat: (0/-2)

dLocal currently has a wide moat due to its high switching costs, its intangible assets, and large recurring customer base.

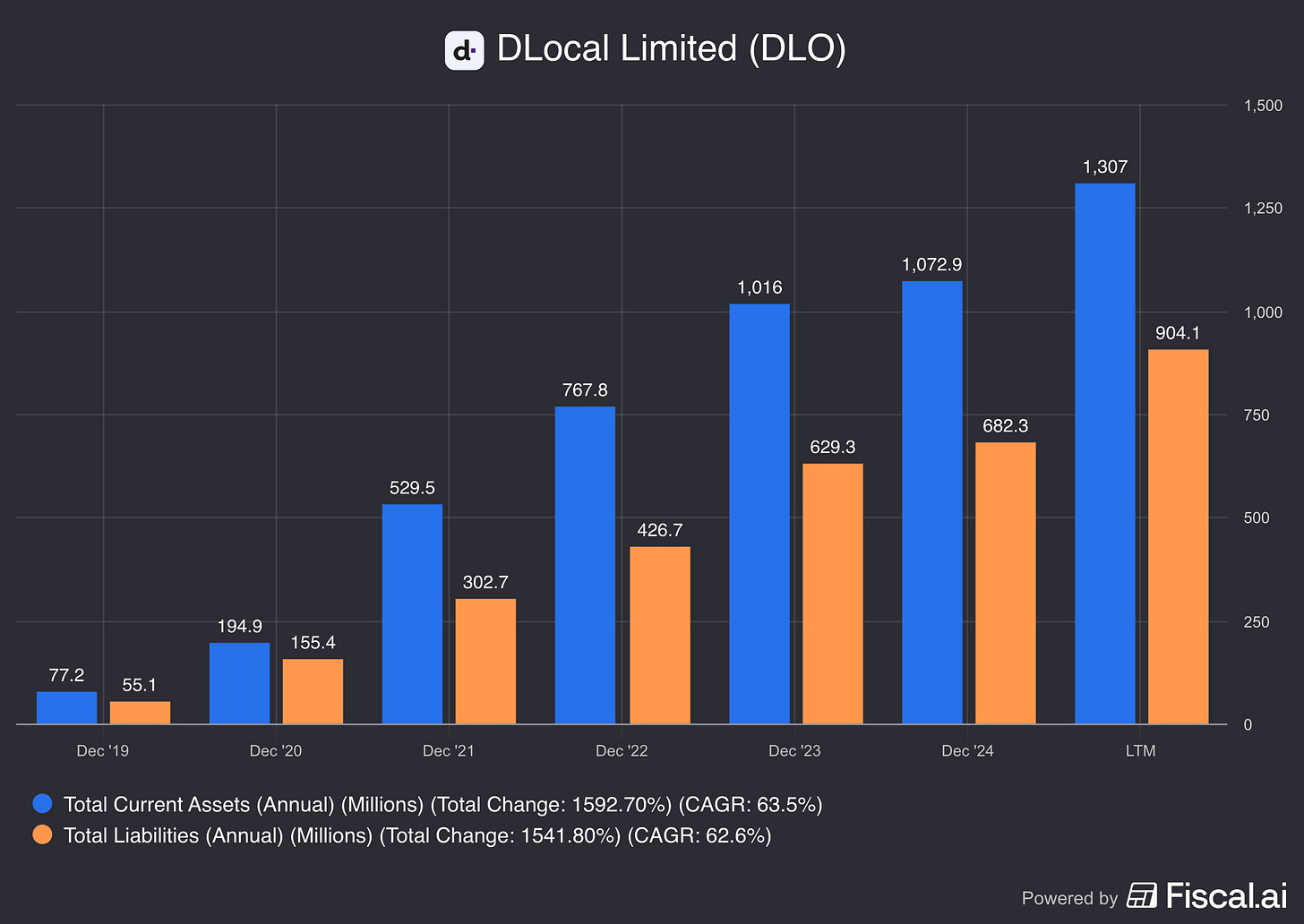

Balance Sheet Risk: (0/-2)

dLocal's balance sheet is very solid. As of November 2025 its current assets were $1.3 billion, while its total liabilities amounted to $0.9 billion.

Lack of Profit Visibility: (0/-2)

dLocal turned profitable in 2016 and has since been profitable every single year.

Regulatory & Geopolitical Risk: (-1/-1)

dLocal’s business model is highly vulnerable to regulatory changes and geopolitical risks as by operating in over 40 EMs it is facing constant risk from sudden regulatory shifts, capital controls, and geopolitical events that can restrict cross-border money movement.

Additionally, its largest vulnerability is FX risk, where currency devaluations in key markets may drastically reduce its revenue, even when the underlying local transaction volume remains robust.

Core Business Disruption: (0/-1)

dLocal’s business model is less vulnerable to technological disruption than other fintechs, as its core function across fragmented EMs is not solvable by a single software solution.

While technologies like blockchain and DeFi pose long-term potential, the company’s current competition comes from large global players investing to aggressively build out localized regulatory infrastructure to compete with dLocal’s offering.

Customer Concentration Risk: (-1/-1)

dLocal faces a significant customer concentration risk, as its 2024 financial reporting highlighted a high reliance on a few key clients:

Two individual merchants each accounted for more than 10% of the company’s total revenue.

The Top 10 customers collectively generated 60% of total revenues.

“In 2024 two merchants (one in 2023 and none in 2022) individually accounted for more than 10% of the Group’s total revenue.” - dLocal’s 2024 Annual Report

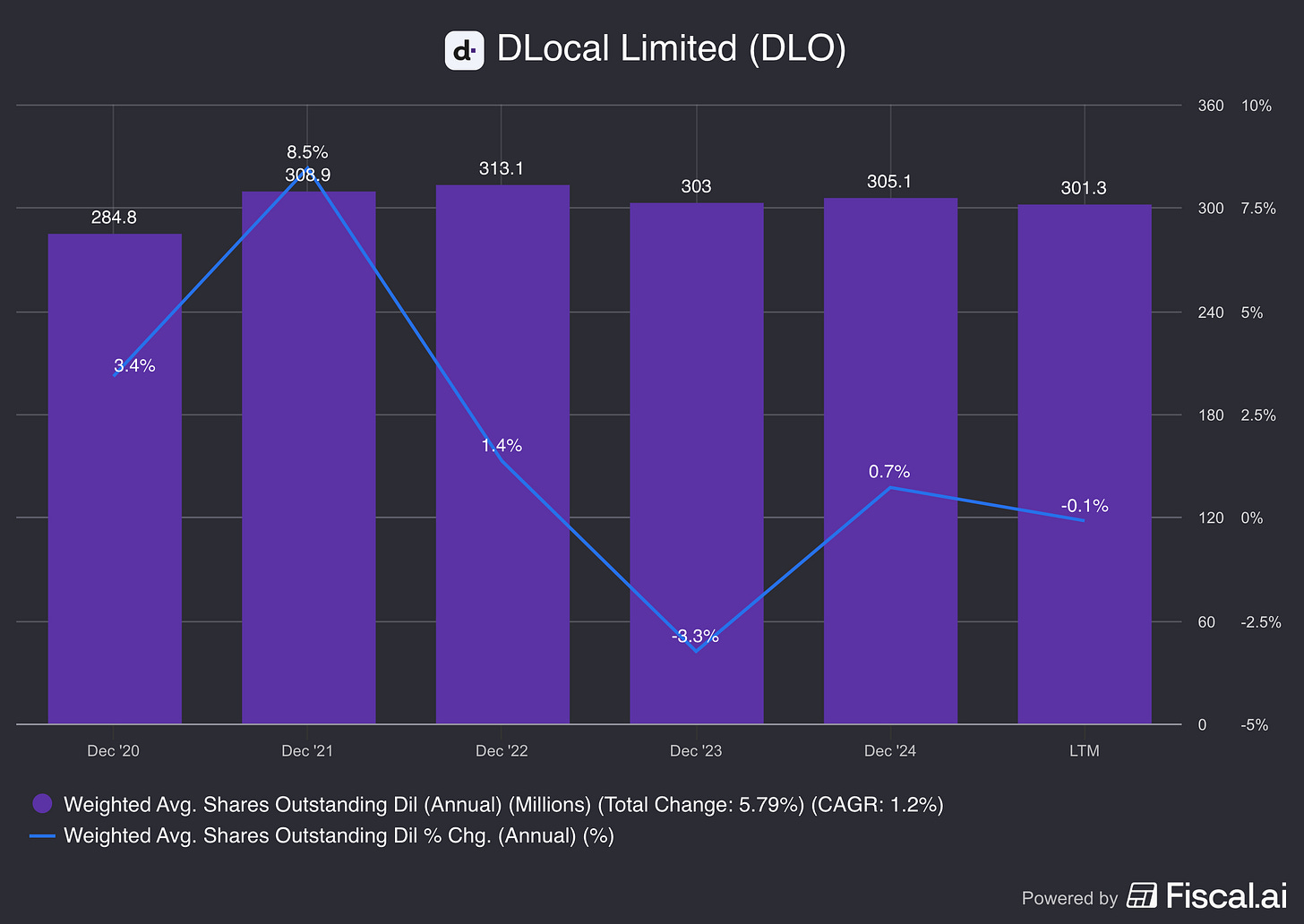

Share Dilution: (0/-1)

dLocal’s total shares outstanding slightly increased by 0.7% from 2023 to 2024, mainly caused due to its SBC, needed to retain top talent.

As the company’s shares outstanding have only grown by 7% in the past 4 years, at a much slower pace than its EPS growth, at the moment it should not be a worry for investors.

dLocal Quality Score (FINAL):

Adding up the scores and deducting one for potential risk, dLocal scores a total of 16/22 points, making it a “High Conviction” business and one which could potentially deserve a deep dive analysis.

I have been impressed by dLocal’s incredible fundamentals such as its ROCE stability, FCF generation predictability, and its robust balance sheet.

However, since the company’s strategy is actively contracting its margins, it is a highly cyclical company, and I don’t fully understand the durability of company’s economic moat, we will not be conducting a Deep Dive on dLocal.

Follow to not miss out, it’s FREE!

We are currently prioritizing making these posts about as many companies as possible to give you the highest chance at identifying the right one for you. However, like this post or leave a comment since, the higher the engagement, the higher the likelihood of us conducting a Deep Dive on the company (as long as it is a “High Conviction” or a “Best-in-Class”).

Thanks for taking the time to read this post!

Best,

The Cash Flow Compounder